The Bank of America Tower has sold for $542 million, according to a report in Real Estate Alert, a newsletter for institutional investors. At $695 a square foot, the deal would mark a record per-foot price for Houston, easily beating the previous record of $528 a square foot. The news shows that there’s a market for new, high-end office space even as Houston’s office market overall suffers from high vacancy rates.

The newsletter reported that the buyer was California teachers’ pension fund manager CalSTRS.

The 35-story tower at 800 Capitol opened this summer with 88 percent of its office space pre-leased. Originally called Capitol Tower, the 754,000-square-foot building was renamed the Bank of America Tower after the bank decided to consolidate its three downtown offices to 210,000 square feet in the project. Other tenants include Waste Management, Winston & Strawn and Quantum Energy Partners.

A lushly landscaped 24,000-square-foot “sky park,” a 35,000-square-foot community hub and culinary market and 10,000-square-foot conference and events center are among the amenities meant to attract tenants to space. According to the tower’s developer, Skanska, the LEED-certified tower uses 32 percent less energy than the typical office tower.

According to commercial real estate firm CBRE, 19.3 percent of Houston’s office space was vacant in the third quarter, and the average annual asking rate was $28.78 per square foot.

HOUSTON—The Residences at The Allen and Lifestyle Pavilion, a multi-use development, recently broke ground, and will include the luxury brand Thompson Hotel, according to DC Partners. In addition, space will include a fitness club, two restaurants, retail spaces, and an office building.

Situated across six acres at the southeast corner of Allen Parkway and Gillette Street, the development overlooking Buffalo Bayou Park will serve as a crossroads between downtown and the Galleria/Uptown area, and Midtown and the Texas Medical Center.

The groundbreaking “is a significant milestone for The Allen,” said Roberto Contreras, CEO of DC Partners, the developer of The Allen. “I am very proud of the dream team we have put together for this project. This is the fourth development for DC Partners with general contractor GT Leach and our second project with Thompson Hotels. Our goal is to change the way Houstonians think about high-rise living and deliver a lifestyle that is representative of luxury hotel living without sacrificing all the privacy of your own home.”

The DC Partners team was joined at the recent groundbreaking by Tianqing Real Estate Development, Westmont Hospitality Group, HOK, Abel Design Group, and GT Leach.

“We’re thrilled to be introducing the Thompson Hotels brand to Houston in our second collaboration with DC Partners in the state of Texas, as part of this landmark mixed-use development,” said Catie Mangels, vice president of residential, lifestyle development and owner relations for Hyatt. “The innovative vision and pioneering spirit behind The Allen are well aligned with the Thompson brand’s legacy as a disruptor in the luxury lifestyle hotel segment.”

The Residences at The Allen will offer services and full amenities provided by the Thompson Hotel, including 24-hour concierge and room service, spa, city views, and a pool deck with cabanas and restaurants. A helistop will be available to hotel guests and residents and is engineered to accommodate drone deliveries and transportation of the future.

“The Allen will be the first new construction development in Houston to have this amenity,” Contreras tells GlobeSt.com. “One of our goals for this project was to incorporate innovative amenities and technologies, as well as thinking about how people will live in the future. This includes drone deliveries as the industry continues to evolve, as well as the future of drones that will transport people. Additionally, the helistop will allow for quick trips to surrounding airports and provide life safety services to the nearby Houston Medical Center.”

The Lifestyle Pavilion will feature 52,000 square feet of retail and restaurant space and is currently 80% leased. Residents and hotel guests will enjoy an endless backyard as it serves as an extension of the outdoor active lifestyle of Buffalo Bayou Park.

The Residences at The Allen are currently 15% sold. The 99 units will consist of one-bedroom, two-bedroom, and three-bedroom condos, as well as 17 penthouses ranging from 919 to 10,000 square feet. Expected delivery of the Lifestyle Pavilion is fourth quarter 2020, with the grand opening during the first quarter of 2021. The hotel-condo tower will be completed in 2023.

The Allen is developed by DC Partners with investment from Tianqing Real Estate Development and Westmont Hospitality Group. The site plan and architecture were led by HOK, and interiors for the hotel and residences were provided by Abel Design Group. Houston-based GT Leach will serve as a general contractor for the hotel, condo and lifestyle pavilion development.

Rents set a record high at $1.18 per square foot, with multifamily occupancy at its highest since the energy downturn, according to a third-quarter report by CBRE. Year-to-date net absorption reached 12,989 units as of the end of the quarter.

Job grew at 2.7%, adding 81,900 jobs. Among these, 22,800 were in professional and business services say CBRE.

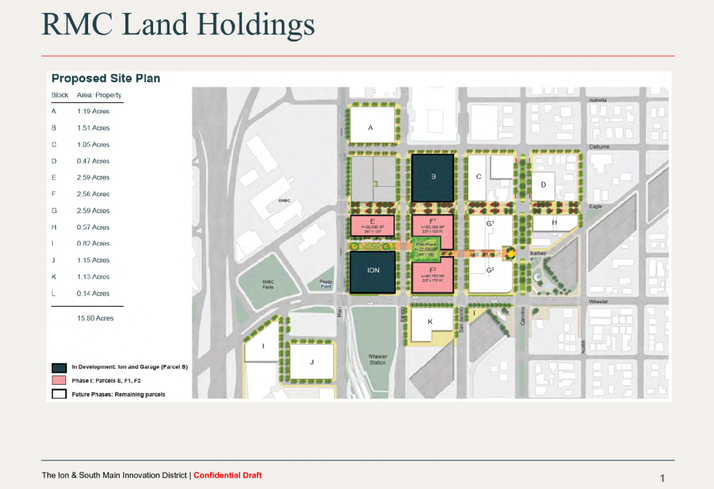

The public finally has a sense of the scope of Rice University’s proposed redevelopment of the former Midtown Sears. Dubbed The Ion Innovation Hub, the project looks to be a game-changer for the surrounding area. In a variance request first reported by the Houston Chronicle, plans show 13 proposed structures with green space connecting them. Work on the Midtown Sears and an accompanying parking garage are well underway and renderings of a finished project have been officially released. Plans for the surrounding area, owned mostly by Rice University, have been vague but ambitious. The documents filed by consulting firm Vernon G. Henry & Associates on behalf of Rice are the first look at plans for the area, which appears to include extensive landscaping.

The plans indicate Phase 1 will focus on the three parcels adjacent to the north, east and northeast of the Midtown Sears site, where three buildings totaling roughly 102K SF and a 22.5K SF civic plaza will be developed. Plans for the rest of the project will come in future phases.

Stockdale Capital Partners has acquired a 433,132-square-foot creative office building in Houston’s Greenway submarket. Principal Real Estate Investors sold the Class A property, while Cigna Realty Investors facilitated the transaction with a seven-year, fixed-rate acquisition loan.

Located at 20 Greenway Plaza, the ten-story asset is within walking distance of several dining and retail options, as well as residential properties. The location provides easy access to Houston’s major thoroughfares and public transit. Originally built as a retail property in 1984, the tower was converted for office use in 2002, according to Yardi Matrix information. Most recently, the building underwent upgrades in 2014.

Also known as the Koch Building, 20 Greenway Plaza was 95 percent occupied at the time of sale. Its tenant roster includes notable companies such as Merrill Lynch, Mitsubishi, Sunnova Energy Corp., REALEC Technologies and Koch.

Principal Real Estate worked with HFF Senior Managing Director Dan Miller and Managing Director Trent Agnew, while the brokerage company’s debt placement team led by Managing Director Trent Agnew arranged the financing on behalf of the buyer. Recently, Miller was part of the team handling the sale of One Sugar Creek Center, a 193,998-square-foot office building in Sugar Land, Texas.

JLL announced today that it has closed the sale of The Mix @ Midtown, a 73,000-square-foot, fully leased Class A retail property that is housed on an entire city block in Houston’s Midtown neighborhood.

JLL marketed the property on behalf of the seller, Crosspoint Properties, who developed the property in 2008. The fifth Corner, in a joint venture with Pointer Real Estate Partners, purchased the asset.

The Mix @ Midtown anchors Houston’s Midtown neighborhood, a highly walkable neighborhood and Houston’s primary 24/7 district near downtown and the Texas Medical Center. The property pioneered the first mixed-use asset in the area. It is fully leased to a best-in-class roster of experiential retailers, including 24 Hour Fitness, Jinya Raman Bar, Artisans Restaurant, Gen Korean BBQ, Piola, Kung Fu Tea, and Cloud 10 Creamery. Situated on 1.43 acres at 3201 Louisiana Street, The Mix @ Midtown spans an entire city block in Houston’s Midtown neighborhood and includes a 296-space parking garage, a unique feature in MIdtown. The property is located at the hard corner of Louisiana and Elgin, which is Midtown’s busiest intersection with approximately 45,000 vehicles passing through daily.

Midtown is sandwiched between the two largest employment centers in Houston, including downtown (300,000 daytime population) and The Texas Medical Center (107,000 daytime population). The demographics in Midtown and around The Mix are staggering, with 188,000 residents with an average annual household income of $127,000 and a daytime population exceeding 400,000 workers within a three-mile radius. The area benefits from access to the METRORail Red Line, which, as one of the nation’s most traveled metro lines based on boardings per track mile, connects downtown Houston to the Texas Medical Center and passes right through Midtown just two blocks from The Mix. Additionally, Midtown is highly walkable, evidenced by a Walk Score of 86, and is flush with parks, art galleries, restaurants, and nightlife. Several major developments are underway in Midtown highlighted by Morgan Group’s Whole Foods-anchored residential building (one block away) and Rice University’s Ion innovation district. Phase I of the Ion will be a $100 million renovation of a 270,000-square-foot Sears, which will serve as a gathering place for startups, large corporations seeking new technologies, venture capitalists, business accelerator and academics.

The JLL Capital Markets team representing the seller was led by Senior Managing Director Rusty Tamlyn, Directors John Indelli and Michael Johnson and Analyst Bryan Strode.

“Packed with high-rise apartments, big incomes, walkability, public transportation, daytime population and greenspace, all the ingredients are in-place for Midtown, which has evolved into one of Houston’s top retail, office, and living destinations,” Indelli said.

JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge deliver the best-in-class solutions for clients — whether investment advisory, debt placement, equity placement or a recapitalization. The firm has more than 3,700 Capital Markets specialists worldwide with offices in nearly 50 countries.